Navigating the Complicated World of Business Formation: Insights and Strategies

Starting the journey of developing a business can be a challenging task, especially in a landscape where guidelines are constantly progressing, and the stakes are high. As entrepreneurs established out to browse the intricate world of firm formation, it ends up being vital to equip oneself with a deep understanding of the intricate subtleties that define the process. From choosing one of the most suitable service structure to making sure rigorous legal compliance and creating effective tax preparation strategies, the path to producing a successful organization entity is riddled with complexities. However, by untangling the layers of ins and outs and leveraging insightful methods, business owners can lead the way for a solid structure that establishes the stage for future growth and sustainability.

Business Structure Selection

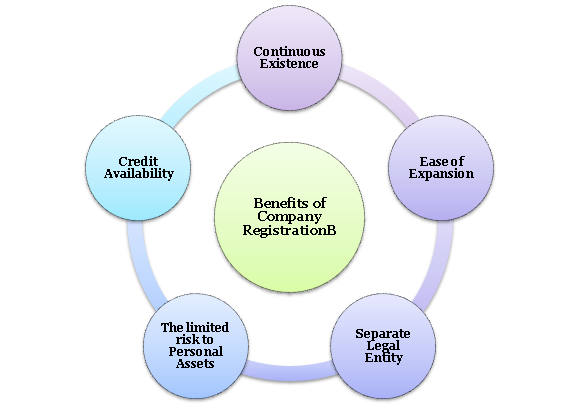

In the realm of company formation, the vital decision of selecting the suitable business structure lays the structure for the entity's functional and legal structure. The selection of business framework substantially affects various elements of the organization, including tax, obligation, management control, and conformity needs. Entrepreneurs should thoroughly assess the readily available options, such as single proprietorship, partnership, restricted obligation firm (LLC), or corporation, to establish one of the most suitable framework that aligns with their organization goals and scenarios.

One usual structure is the sole proprietorship, where business and the proprietor are taken into consideration the same legal entity - company formation. This simpleness enables ease of development and full control by the proprietor; however, it likewise involves unrestricted individual responsibility and prospective challenges in raising funding. Collaborations, on the other hand, include 2 or even more people sharing losses and profits. While partnerships offer common decision-making and resource merging, companions are directly responsible for the organization's financial debts and commitments. Recognizing the subtleties of each company framework is important in making an educated decision that establishes a strong groundwork for the company's future success.

Legal Conformity Basics

With the structure of a suitable business framework in location, ensuring lawful compliance essentials comes to be vital for securing the entity's operations and keeping governing adherence. Legal compliance is critical for business to run within the limits of the law and avoid possible penalties or lawful issues.

To guarantee legal compliance, business must routinely examine and upgrade their procedures and policies to mirror any kind of adjustments in laws. Seeking legal guidance or compliance professionals can further assist firms browse the intricate lawful landscape and remain up to day with advancing policies.

Tax Planning Considerations

Additionally, tax planning click reference must encompass methods to make use of readily available tax obligation deductions, incentives, and credit histories. By strategically timing income and expenditures, organizations can possibly reduce their taxed revenue and total tax concern. It is also essential to remain educated regarding modifications in tax regulations that may affect the service, adapting approaches as necessary to stay tax-efficient.

Additionally, international tax obligation preparation considerations might develop for companies operating throughout boundaries, entailing complexities such as transfer rates and international tax credit scores - company formation. Looking for support from tax specialists can assist browse these complexities and develop an extensive tax strategy tailored to the business's needs

Strategic Financial Administration

Purposefully taking care of finances is a basic aspect of guiding a company in the direction of lasting growth and productivity. Efficient economic administration entails an extensive method to overseeing a business's monetary resources, financial investments, and total monetary health and wellness. One vital element of critical financial administration is budgeting. By developing thorough budgets that line up with the firm's objectives and objectives, services can allocate resources effectively and track efficiency versus monetary targets.

Keeping track of cash inflows and outflows, managing operating capital effectively, and making sure adequate liquidity are essential for the everyday procedures and long-term stability of a business. By identifying economic threats such as market volatility, credit rating threats, or regulative adjustments, business can proactively apply procedures to secure their monetary security.

Furthermore, economic reporting and evaluation play a vital his explanation function in tactical decision-making. By creating precise financial records and performing extensive evaluation, businesses can get valuable insights into their financial performance, recognize locations for renovation, and make educated critical choices that drive lasting development and success.

Development and Development Methods

To drive a company towards boosted market visibility and profitability, tactical growth and development strategies should be thoroughly designed and implemented. One efficient technique for development is diversity, where a firm gets in new markets or offers new service or products to decrease dangers and utilize on emerging possibilities. An additional technique is market infiltration, concentrating on increasing market show existing items in present markets with aggressive advertising or prices methods. In addition, calculated collaborations or cooperations with various other services can supply accessibility to brand-new resources, technologies, or markets that increase development. Acquisitions and mergers can be critical for broadening market reach, getting competitive benefits, or getting essential talent. It is crucial for firms to carry out complete market research study, financial evaluation, and danger assessments before embarking on any kind of growth strategy to make certain sustainability and success. By meticulously preparing and executing growth methods, business can navigate the intricacies of development while optimizing value for stakeholders.

Final Thought

To conclude, browsing the complexities of firm development requires mindful factor to consider of company framework, lawful compliance, tax obligation planning, economic monitoring, and growth approaches. By tactically selecting the appropriate company framework, guaranteeing legal conformity, preparing for tax obligations, handling finances properly, and executing development methods, companies can establish themselves up for success in the affordable company environment. It is crucial for services to approach firm formation with a critical and extensive frame of mind to accomplish lasting success.

In the realm of firm formation, the vital choice of selecting the proper organization structure lays the foundation for the entity's functional and lawful structure. Business owners should meticulously assess the readily available choices, such as sole proprietorship, collaboration, limited responsibility business (LLC), or firm, to establish the most appropriate framework that aligns with their business objectives and circumstances.

By creating in-depth spending plans that straighten click with the company's goals and objectives, organizations can allocate resources efficiently and track performance versus monetary targets.

In conclusion, navigating the complexities of company development needs careful consideration of company structure, lawful conformity, tax preparation, financial management, and growth techniques. By strategically selecting the best company framework, making sure legal compliance, preparing for taxes, managing finances efficiently, and carrying out growth techniques, companies can set themselves up for success in the affordable organization atmosphere.